Inflation is one of those terms we often hear, but do we fully understand its impact? When inflation rises, it affects the prices of everything—from groceries to gas, and even housing. Recently, there’s been some good news on the inflation front, specifically in the U.S., as the Federal Reserve’s key inflation gauge has come in lower than anticipated. Let’s dive deep into what this means and why it matters for your wallet, future interest rates, and the broader economy.

What Is Inflation and Why Should You Care?

At its core, inflation measures how much prices for goods and services increase over time. If inflation is too high, everything becomes more expensive, and your purchasing power decreases. On the flip side, if inflation is low or falling, it could signal an economy that is stabilizing, allowing for things like interest rate cuts, which affect everything from mortgages to loans.

Understanding the Fed’s Inflation Target

The Federal Reserve (Fed), which acts as the central bank of the U.S., has a specific inflation target—2% annually. This target helps ensure that the economy grows steadily without causing too much financial pain for consumers. When inflation stays near this level, it allows the Fed to maintain a balance between promoting economic growth and keeping prices stable.

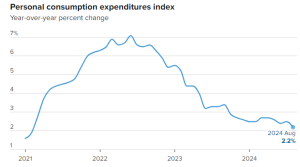

August Inflation at 2.2%: What Does It Mean?

In August, the Commerce Department reported that inflation moved closer to the Fed’s target, which might be great news for future interest rate cuts. The Personal Consumption Expenditures (PCE) price index, a favored gauge by the Fed to measure the cost of goods and services, increased by 0.1% for the month, putting the 12-month inflation rate at 2.2%, down from 2.5% in July. This is the lowest inflation rate since February 2021.

What’s significant here is that economists, specifically those surveyed by Dow Jones, were expecting the PCE to rise 0.1% month-on-month and 2.3% year-on-year. So, the actual number of 2.2% came in slightly lower than predicted, offering optimism that inflation is finally cooling off.

Core PCE: The Fed’s Focus

While the all-items PCE showed positive signs, the core PCE, which excludes more volatile items like food and energy, also rose by 0.1% in August. Year-on-year, core PCE was up 2.7%, which is slightly higher than the July figure of 2.6%. This slight increase is still within expected ranges, but it shows that certain areas of inflation remain sticky.

Why does the Fed focus on core inflation? Because it strips out the more unpredictable elements of the economy, making it a better measure of long-term inflation trends.

Personal Spending and Income: A Missed Target?

While the inflation numbers were positive, both personal spending and income reports fell short of expectations. Personal income increased by only 0.2% on the month, and personal spending followed suit with another 0.2% increase. The forecasts for these metrics were 0.4% and 0.3%, respectively.

These smaller-than-expected rises may signal that consumers are becoming more cautious, likely due to uncertainty in the job market and inflation’s ongoing effects.

Market Reaction: Stocks Up, Treasury Yields Down

Financial markets are always quick to react to economic data, and this report was no different. Stock market futures turned positive following the announcement, while Treasury yields dipped. Why? Investors are betting that with inflation easing, the Fed may slow or pause interest rate hikes, making the stock market more attractive.

Interest Rate Cuts on the Horizon?

One of the most important takeaways from this inflation report is how it might influence future interest rate decisions. The Federal Reserve recently reduced its benchmark overnight borrowing rate by 0.5 percentage points, bringing it down to a target range of 4.75% to 5%.

Now, with inflation closer to the Fed’s target, future cuts could be in store. Fed officials are already hinting at further reductions of 0.5 percentage points this year and potentially a full point in 2025. Markets, however, are pricing in an even more aggressive path for cuts, which could provide more relief for borrowers.

Housing and Services: Areas of Pressure

Despite the overall positive trend in inflation, housing-related costs remain a thorn in the side. Housing prices increased by 0.5% in August, marking the largest monthly move since January. In contrast, goods prices dropped by 0.2%, signaling that the cost of services (like rent and medical care) continues to be a key driver of inflation.

The Shift in Focus: From Inflation to Employment

In recent weeks, the Fed has begun shifting its focus from inflation control to supporting the labor market, which is showing some signs of softening. Unemployment rates and job creation metrics will now play a more critical role in future interest rate decisions.

What’s Next for the U.S. Economy?

While this inflation report is encouraging, it doesn’t mean the U.S. economy is entirely out of the woods. Economic growth appears to be slowing, and there are signs that the labor market is softening. However, with inflation easing, it gives the Federal Reserve more room to cut interest rates and stimulate growth without fear of runaway prices.

Breaking Down the Fed’s Role

To understand the significance of this inflation report, it’s essential to grasp how the Federal Reserve operates. The Fed uses interest rates as a tool to control inflation. When inflation is high, the Fed increases rates to slow down economic activity and prevent prices from spiraling out of control. On the flip side, when inflation is low or close to the target, the Fed can reduce rates to stimulate the economy.

How Does This Affect You?

So, what does this mean for everyday Americans? If inflation continues to decrease and the Fed lowers interest rates further, you could see:

- Lower mortgage rates, making it cheaper to buy a home.

- Decreased loan rates, which means personal loans, student loans, and car loans could become more affordable.

- Higher stock market returns, as businesses benefit from lower borrowing costs.

On the downside, lower interest rates might also mean lower returns on savings accounts and bonds, so savers might need to adjust their investment strategies.

Global Implications: How the U.S. Influences the World Economy

The U.S. economy plays a massive role in the global market, so changes in inflation and interest rates here ripple out to other countries. For instance, if the Fed cuts rates, it could make the U.S. dollar weaker compared to other currencies. This shift might boost exports, as American goods become cheaper for other countries to buy, but it could also increase the price of imports.

A Positive Step Forward

To sum up, the lower-than-expected inflation report for August is a positive sign for the U.S. economy. While challenges like high housing costs remain, the broader trend suggests that inflation is moving in the right direction. This progress could pave the way for more interest rate cuts, making borrowing cheaper and helping to stimulate growth. However, the path forward isn’t without its obstacles, and much will depend on how the labor market evolves in the coming months.