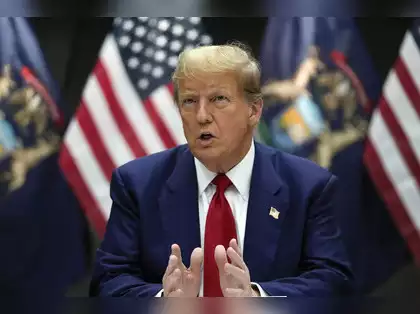

In late September, Trump Media revealed that its Chief Operating Officer (COO) Andrew Northwall had resigned. This announcement came through a regulatory filing, which also detailed significant developments in a legal battle involving the company’s shares. Simultaneously, former President Donald Trump’s social media company confirmed it would be releasing nearly 800,000 shares to an early investor, ARC Global Investments II, following a Delaware court ruling.

At the heart of this article, we’ll explore how Northwall’s resignation impacts Trump Media, the intricacies of the court fight over stock shares, and what these changes mean for the future of the company and its investors.

What Led to the COO’s Resignation?

In September, Andrew Northwall stepped down from his position as COO of Trump Media. The company provided little information about the reasons behind his departure, saying only that it plans to transition his duties internally. Northwall’s resignation occurred amid a high-stakes legal dispute, but no direct connection was made between the lawsuit and his decision to leave.

This move raises questions. Was Northwall’s exit a personal choice, or could it be linked to ongoing challenges within the company, especially as it battles legal issues related to its stock and investor agreements? The timing certainly leaves room for speculation.

The Delaware Court Ruling: What’s It All About?

In mid-September, Delaware Chancery Court Judge Lori Will ruled that Trump Media had breached an agreement with ARC Global Investments II, a key player in the merger between Trump Media and Digital World Acquisition Corp (DWAC), a blank-check firm. The dispute centered around the correct calculation of the number of Class A shares ARC was owed after the companies merged.

DWAC’s stock-conversion ratio was deemed too low, with the court deciding in favor of ARC. As a result, 785,825 shares of Trump Media’s common stock were released to ARC.

But that’s not the whole story. While ARC was awarded more shares than DWAC initially calculated, the judge also rejected ARC’s proposed, higher conversion ratio. This middle-ground decision has created a ripple effect in the company’s stockholding structure.

Trump Media’s Complex Relationship with DWAC

To understand how this legal battle unfolded, it’s important to know how Trump Media and DWAC became intertwined. DWAC, a special purpose acquisition company (SPAC), was formed to facilitate mergers and acquisitions. The idea was simple: DWAC would raise funds through its public listing and then merge with Trump Media, allowing Trump’s company to go public without the traditional IPO process.

However, the relationship between Trump Media and DWAC has been anything but smooth. The merger was completed in late March 2024, but since then, legal disputes and regulatory scrutiny have plagued both companies.

One of the biggest challenges has been the lawsuit filed by ARC Global Investments II, which claims that Trump Media owes it a larger portion of shares than originally calculated. This battle over stock allocation has far-reaching consequences for investors and the value of DJT, the ticker under which Trump Media trades on the Nasdaq.

Trump’s Stock and Investor Dynamics: What You Need to Know

Former President Donald Trump holds a majority stake in Trump Media, owning nearly 57% of the company’s stock. On paper, this ownership amounts to nearly $1.9 billion. However, Trump and other company insiders, including ARC, were restricted from selling their shares until September 19, 2024, when a lock-up agreement expired.

Interestingly, shortly after the expiration of the lock-up, United Atlantic Ventures, a major shareholder, sold nearly its entire 11-million-share stake. This stake could have been worth at least $128 million, based on the stock’s price range post-lockup.

Trump, however, has publicly vowed not to sell his shares. Whether this pledge will hold long-term remains to be seen, especially as the company navigates ongoing legal and financial pressures.

What Does the Legal Battle Mean for Trump Media’s Future?

The ongoing legal issues with ARC Global Investments II have left Trump Media in a precarious position. By releasing nearly 800,000 shares to ARC, the company has taken a step toward resolving the dispute. However, the court ruling doesn’t mark the end of its legal troubles.

The complex nature of SPAC mergers, combined with disagreements over stock-conversion ratios, could potentially weaken investor confidence in Trump Media. For example, Patrick Orlando, the original CEO behind DWAC, was forced out in 2023 amid accusations of misleading public filings about the merger with Trump Media.

Further complicating matters is the SEC’s lawsuit against Orlando, which accuses him of fraudulently hiding details about the merger. The SEC’s demands include turning over all “ill-gotten gains” from the alleged fraud and civil penalties. The agency is also seeking to bar Orlando from serving as an officer or director of a publicly traded company. This legal scrutiny adds yet another layer of uncertainty to Trump Media’s future.

The Role of Truth Social in the Bigger Picture

One of Trump Media’s flagship ventures is the social media platform Truth Social, which was created as an alternative to mainstream platforms like Twitter and Facebook. Truth Social operates under a similar structure to Twitter, offering users a space to share thoughts and content, with a strong focus on free speech.

While Truth Social has gained a dedicated user base, its success remains tied to the larger fortunes of Trump Media. The legal disputes and challenges surrounding the company’s stock and leadership could influence Truth Social’s future growth.

As Trump Media navigates its current struggles, the platform’s users and stakeholders are likely to keep a close eye on developments within the company.

A Glimpse at the Financial Impact of the Lawsuit

At the core of the ARC lawsuit is the value of shares, and these numbers are far from trivial. Based on Thursday’s closing price, the 785,825 shares awarded to ARC were worth around $12.7 million. For ARC, this represents a significant windfall, but for Trump Media, it could mark a notable financial hit.

Releasing these shares dilutes the company’s stock and could impact its overall market value. For investors, particularly those who have stuck with DJT through its roller-coaster ride of legal and financial challenges, this development may raise concerns about the company’s ability to maintain its value moving forward.

What’s Next for Trump Media?

With Andrew Northwall’s departure and the resolution of part of the legal dispute with ARC Global Investments II, Trump Media is at a crossroads. The company faces numerous challenges, from regulatory scrutiny to investor uncertainty. However, with Trump still holding a majority stake and vowing not to sell, his continued involvement could stabilize the company—at least for the short term.

It will be critical for Trump Media to address its internal leadership changes, ensure transparency with investors, and focus on expanding Truth Social if it wants to remain a significant player in the digital media space.

Final Thoughts: Navigating Challenges and Uncertainty

For Trump Media, the resignation of Andrew Northwall and the Delaware court ruling have created a period of transition and uncertainty. The company’s ability to navigate these challenges will depend on how it manages its internal changes, legal battles, and financial obligations.

With Trump’s continued ownership, the company will remain in the public eye, but whether it can weather the storm of legal disputes and internal shifts remains to be seen. Investors, employees, and users of Truth Social will all be watching closely as the next chapter in Trump Media’s story unfolds.